The top Chinese live-streamer, Viya is fined 1.34 billion RMB

On Dec 20th, 2021, Xinhua Net published a breaking news that the No.1 Chinese live streamer in e-commerce, Wei Huang aka Viya, is fined 1.34 billion RMB (210 million USD) for dodging tax by the Hangzhou Taxation Administration. This is the largest fine ever imposed on an internet influencer in China.

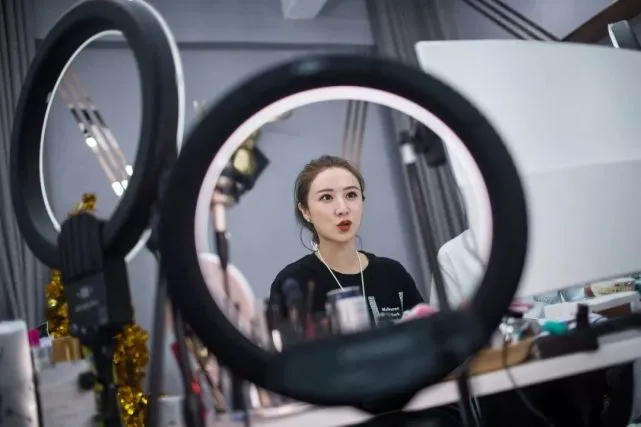

Viya, as the Online Sales Queen, is a 36 years old live streamer on Taobao. She is known for her incredible sales technique through live streaming even successfully sold a rocket launch service for 40 million RMB in 2020. She ranked as the 5th of the most potential business women in 2021 on Forbes China list. It is estimated that Viya and her husband own a wealth of over 9 billion RMB and ranked 490th on the 2021 Forbes China Rich List.

Viya is not the single case

Only one month ago, two influential live streamers Xueli (Cherie) and Lin Shanshan (Sunny) were fined 65.55 million RMB and 27.67 million RMB respectively, for dodging taxes by the Hangzhou Taxation Administration.

Xinba, No.3 on the list above, was banned for 60 days on Kuaishou App for selling fake products. Before that, he was the top live streamer on Kuaishou and took up 1/3 to the total sales revenue generated on the platform in 2019. After the scandal, Kuaishou restricts the app traffic to Xinba’s streaming. According to another influencer on Kuaishou, the platform would like to allocate the traffic into different influencers. They would like to have 10 influencers with 4 million followers rather than 1 influencer with 40 million followers so that the platform can have a better control of the influencers.

Income structure of a live streamer

You may wander, how can a live streamer on e-commerce platform making such a huge amount of money? The income of a live streamer usually consists of two parts, commission-based fee and the participating fee in the live streaming paid by the brands.

The commission of Viya, according to my experience, is usually 20% -25% of the sales revenue generated from her live streaming. Alone in Double 11 in 2021, the estimated total sales revenue generated through Viya’s live streaming reached 8.3 billion RMB. That is to say, she and her team earned approximately 2 billion RMB during the double 11 in 2021.

The participating fee is the fee that a brand pays to the influencers to participate in the live streaming. This fee varies not only from the level of influencers but also from the promotion timing. Viya charges 0.5 – 0.6 million RMB per product during Double 11. The top influencers live stream at least 100 SKUs per day. That is to say Viya makes at least another 50 million RMB per day during Double 11 in 2021.

Besides, top influencers also established a giant business matrix. Taking Viya for example, since 2019 she and her husband hold 16 companies in e-commerce, apparel trading, distribution, business services and etc.

Top Live streamers on e-commerce platforms

Data from the Ministry of Commerce of the People’s Republic of China showed that in the first quarter of 2020, the number of e-commerce live streamings exceeded 4 million times. In 2020, top 10 live streamers across the whole Chinese internet came from Taobao and Kuaishou.

| Ranking | Platform | Influencer | Goods sold (million pieces) | Sales revenue (billion RMB) |

| 1 | Taobao | Wei Huang (Viya) | 2771.4 | 38.7 |

| 2 | Taobao | Jiaqi Li (Austin) | 187.3 | 25.2 |

| 3 | Kuaishou | Youzhi Xin (Xinba) | 85.7 | 8.7 |

| 4 | Taobao | Xueli (Cherie) | 32.5 | 6.7 |

| 5 | Kuaishou | Dandan | 55.6 | 4.8 |

| 6 | Taobao | Lier (Lie Er Bao Bei) | 30.6 | 4.1 |

| 7 | Kuaishou | Dongdong He | 11.5 | 3.9 |

| 8 | Kuaishou | Sanda Ge | 8.35 | 3.5 |

| 9 | Taobao | Jie Chen (Kiki) | 23.3 | 3.0 |

| 10 | Kuaishou | Mao Meimei | 65.1 | 2.7 |

From the table above, it is easy to find out that there is a huge gap between the middle level live streamers and top live streamers. For example, the 10th live streamer only achieved 7% of the sales revenue as Viya did with a gap of 36 billion RMB. The uneven distribution is more serious than the Pareto’s law (80/20 rule). That is to say, Taobao is really rely on the sales revenue generated by the top influencer and allocate extra recourses to meet the need of the top influencers. The Taobao Live streaming ecosystem is now dominated by Viya and Jiaqi Li. This is not what Taobao would love to see.

The impact on e-commerce

The live streaming is a fast-rising industry with relatively higher incomes compared with other industries. But the government supervision was not able to fully catch up due to a lack of technological and legal support.

For state authorities

Viya case together with other cases will certainly strengthen the supervision of live streaming and e-commerce platform. Since 2020, the State Administration for Market Regulation and National Radio and Television Administration published several important documents, such as Guidance from the General Administration of Market Regulation on strengthening the supervision of live online marketing activities and Notice on strengthening the management of live network shows and live streaming e-commerce. The State Taxation Administration said in September 2021 that it will strengthen tax administration in the entertainment sector, including live streaming. There will be more enhanced regulations that can boost market confidence.

For brands

The regulations on live streaming industry may weaken the bargaining power of the influencers. Therefore, the brand can have more control over the promotion, the sales revenue and product return rate. At the moment, many brands realize that live streaming with top influencers is a double-edged sword. Sure, the influencers can bring huge traffic to the shop and a huge lift in sales. But these is no guarantee of brand recognition and repurchase rate. Many brands may not break even through the live streaming. Sometimes, after the live streaming, the return rate is also unexpected high. Many consumers purchased the products just because of the attractive price and the trust in influencer without knowing if the products fit them or not.

For e-commerce platforms

This is a good chance to rearrange the resources for a healthier live streaming ecosystem. At the moment, the 1st and 3rd live streamers on Taobao are banned because of tax dodging. The resources (consumer traffic, cooperation opportunities with brands and etc.) can be now allocated to the middle level live streamers and brands’ own shops. This would be a more robust way of growing rather than being monopolized by the top influencers.

For consumers

The good news is the regulation will be tighter and the rights of consumers can be better protected. The bad news is, the funs of Viya need to find a substitute.