Establishing a Company in China: Choosing the Right Organization Form Ⅱ

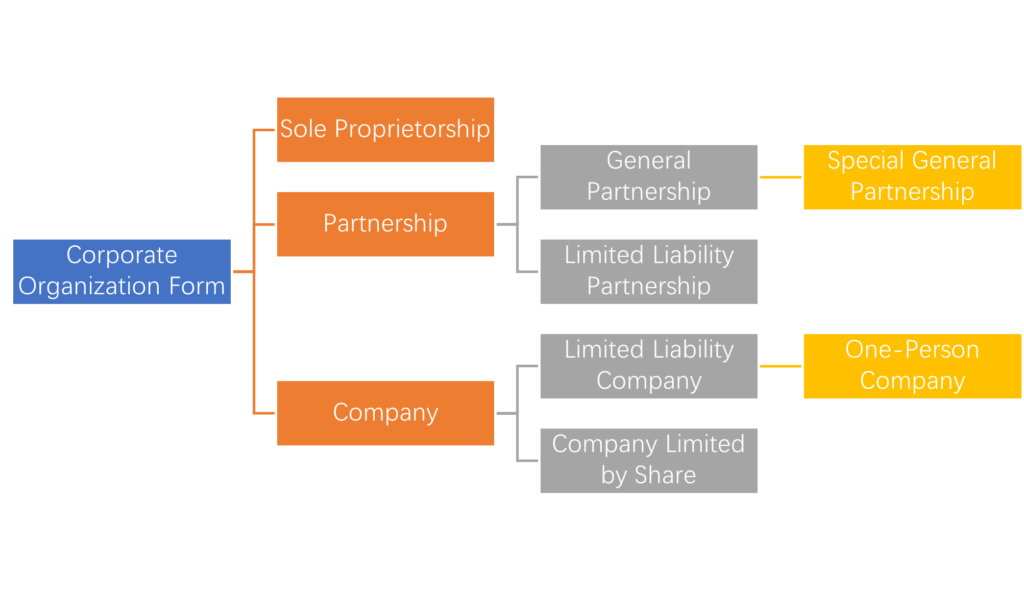

In the previous article, we introduced main organization forms of enterprise as stipulated in Chinese commercial law. Here, we’ll briefly discuss the characteristics of different organization forms.

1. Sole Proprietorship

The founder of a sole proprietorship enjoys a great deal of autonomy. In addition to fulfilling legal tax obligations, maintaining accounting records, and safeguarding the legitimate rights and interests of employees, the founder has full decision-making power over the enterprise. However, investors bear unlimited liability for the enterprise’s debts, concentrating entrepreneurial risks excessively. Simultaneously, funding capabilities are limited, making it suitable for small-sized entrepreneurship. Regarding taxation, sole proprietorships only pay individual income tax and are exempt from enterprise income tax.

It’s important to note that foreigners are not allowed to establish sole proprietorships in China. The natural person shareholders of a sole proprietorship must be Chinese nationals.

2. Partnership Enterprise

In a general partnership enterprise, investors bear unlimited joint liability for the enterprise’s debts. Each general partner enjoys equal rights in the management and execution and can represent the partnership externally. Therefore, it is suitable for partners who have a high level of trust among themselves.

If entrepreneurs want full control over the management of the partnership enterprise while also seeking to introduce financial investors, establishing a limited liability partnership might be a good choice. In practice, limited liability partnerships are often used as the basic structure for employee stock ownership platforms. The distribution of profits in a limited liability partnership can be freely arranged through partnership agreements, making it more flexible. Regarding taxation, partnership enterprises are not subject to enterprise income tax at the partnership level. Instead, each partner assumes tax obligations individually. If the partners are individuals, they pay individual income tax, while if the partners are legal entities or other organizations, they pay enterprise income tax.

3. Company

In companies, investors’ investment risks are predetermined and manageable, as their liability for debts accrued during the company’s existence is restricted to their capital contributions, thus benefiting from limited liability protection. Entrepreneurs aiming to establish a relatively small-sized enterprise with improved access to financing and a desire to mitigate entrepreneurial risks within an acceptable range may find it prudent to establish a limited liability company. A company is recognized as a separate legal person under the law, meaning that theoretically, it exists indefinitely during its lifespan and does not terminate due to the withdrawal or death of investors.

The capital of a company limited by shares is divided into equal shares, with higher flexibility in share transfer, thus offering optimal financing capability. In a company limited by shares, management rights are separated from ownership, often involving professional managers in corporate governance, leading to more scientific management decisions. However, the establishment process is complex and costly, making it more suitable for established growing businesses. As a startup, a company limited by shares is not the optimal choice.

In terms of taxation, a company’s profits are subject to enterprise income tax, and investors’ dividends are also subject to individual income tax.

Furthermore, the newly revised “Company Law of the People’s Republic of China” will come into effect on July 1, 2024. Anber Consulting will soon provide a summary of the revisions to the new company law and highlight the new provisions that require attention.

Are you considering selling products or offering services in China but lack familiarity with the local laws? Anber Consulting offers customized compliance advice, analyzing relevant Chinese laws and regulations in your industry and keeping you informed of legal requirements and updates.