Establishing a Company in China: Choosing the Right Organization Form

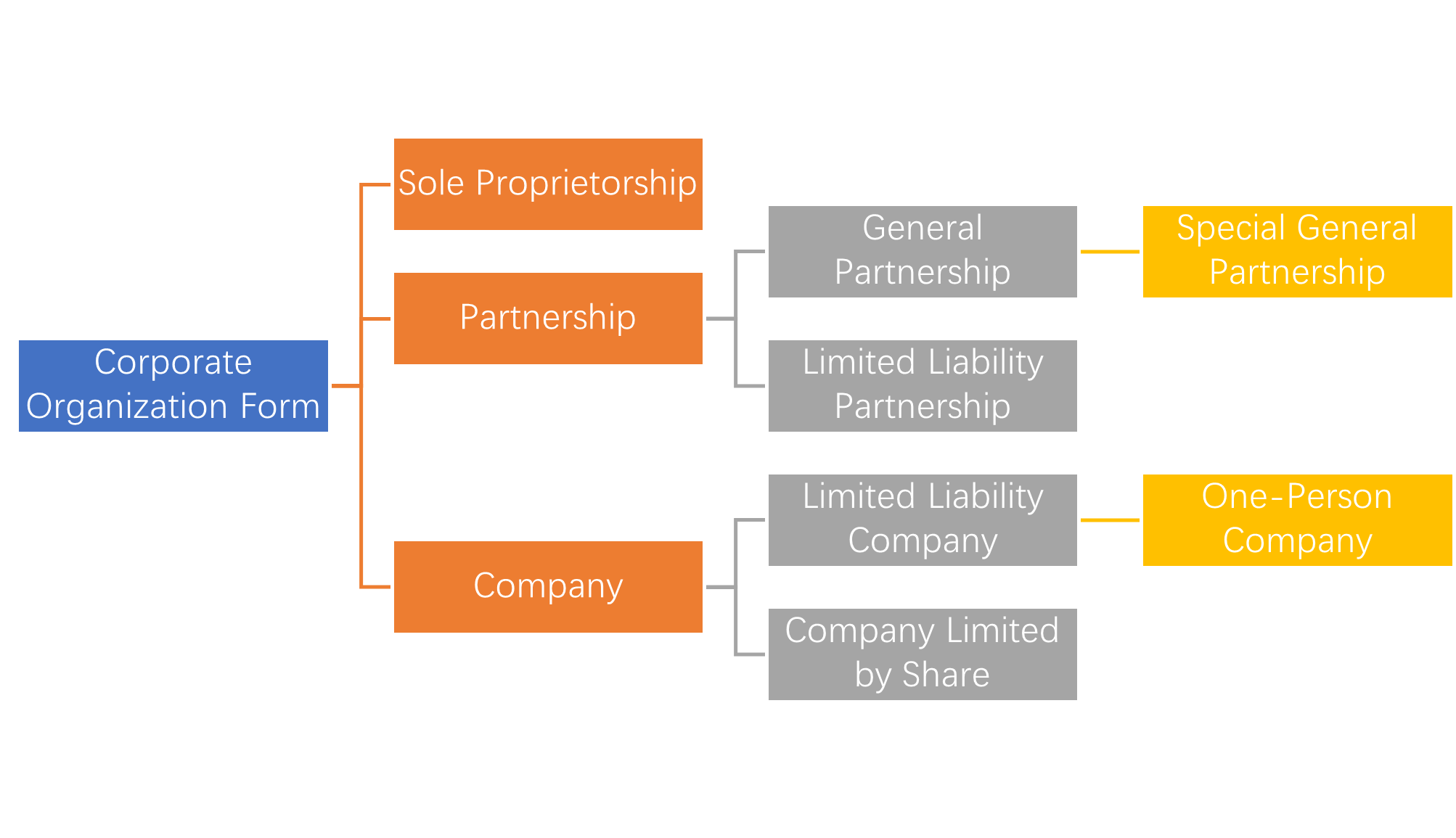

Before establishing a company in China, it is essential to understand the available organizational forms and consider which one is most advantageous for your business. The core differences among various organizational forms lie in the structure of corporate property and the differing legal liabilities borne by the members. According to China’s commercial laws, the main types of organizational forms for enterprises are as follows:

1. Sole Proprietorship:

A sole proprietorship is established within China by a natural person investing individually, with the property owned by the investor personally. The property is owned by the investor personally and the investor bears unlimited liability for the debts of the enterprise with his personal property. While the investor enjoys ownership and independent operational rights, they are personally responsible for all debts incurred during the existence of the sole proprietorship.

Relevant Law: Sole Proprietorship Law of People’s Republic of China

2. Partnership:

A partnership enterprise is formed for mutual profit by two or more partners who contribute jointly, operate jointly, share profits, and bear risks according to a partnership agreement. Partners assume unlimited joint and several liability for the enterprise’s debts.

In China, partnership enterprises are further categorized into general partnerships, special general partnerships, and limited liability partnerships.

General Partnership:

All partners bear unlimited joint and several liability for the enterprise’s debts, suitable for enterprises with high trust among partners. Major decisions require unanimous consent of all partners.

Special General Partnership:

A special general partnership is a form of general partnership used by professional service organizations that provide paid services to clients with specialized knowledge and expertise. For example, accountants, law firms and other professional service organizations often use the special general partnership. Its special feature lies in the different principle of liability for the debts of the enterprise, which is a mixed form of limited liability and unlimited joint and several liability.

Limited Liability Partnership:

This type of partnership consists of general partners and limited partners, with at least one limited partner. The general partner has unlimited joint and several liability for the debts of the partnership. The limited partner is liable for the debts of the partnership to the extent of the amount of his subscribed capital contribution, and the risk of his investment is pre-emptively controllable. The limited partners do not have the right to execute partnership affairs and cannot represent the limited partnership externally, therefore, the role played by the limited partners is that of capital contributors, and they do not participate in the management of the enterprise. In practice, limited partnership is often used as the basic structure of employee shareholding platform.

Relevant Law: Law of the People’s Republic of China on Partnerships

3. Company:

Distinguished from the sole proprietorships and partnerships, a company has an independent legal personality. A company is an enterprise legal person, has independent legal person property, enjoys legal person property right. The company assumes responsibility for its debts with its entire assets. The shareholders of a Limited Liability Company are liable to the company to the extent of their capital contribution, the shareholders of a Company Limited by Share are liable to the company to the extent of their subscribed shares.

China’s Company Law provides for two types of companies, the Limited Liability Company and the Company Limited by Share. It also specifies a special form of Limited Liability Company, known as a One-Person Company.

Limited Liability Company:

A Limited Liability Company, also known as a limited company, refers to a legal entity formed by a specified number of shareholders. Shareholders bear limited liability for the debts of the company to the extent of their subscribed capital contributions. The company, as a legal person, assumes responsibility for external obligations with its entire assets. Limited Liability Companies are suitable for small to medium-sized enterprises.

One-Person Company:

A One-Person Company is a special type of Limited Liability Company where the number of shareholders is one natural person or a legal entity.

Company Limited by Share:

A Company Limited by Share, also known as a Joint-Stock Company, is an enterprise corporation in which the entire capital of the company is divided into equal shares, the shareholders bear limited liability for the debts of the company to the extent of the shares they subscribe for, and the company bears liability for the debts of the company to the extent of all its assets.

Relevant Law: Companies Law of the People’s Republic of China

Are you thinking about selling products or offering services in China, but don’t know much about the laws there? Anber Consulting provides tailored Compliance advice, analyzing Chinese laws relevant to your industry and keeping you informed of legal requirements and changes.